Understanding the Mortgage Process for Lenders

The mortgage process can often feel overwhelming, both for potential borrowers and lenders alike. For lenders, understanding the intricacies of this system is crucial in managing risks, ensuring compliance, and facilitating a smooth and efficient loan experience for customers. From initial pre-approval to final closing, every step requires thorough knowledge and careful execution. This article dives deep into the mortgage process for lenders, providing insights and best practices to navigate this essential financial service. It’s vital for lenders to not only follow steps but to understand their implications and the relationships involved. To navigate the intricacies of the mortgage process for lenders, we will explore each stage, common challenges, solutions, and how to measure success in mortgage lending.

The Importance of Mortgage Pre-Approval

Pre-approval is the first significant step in the mortgage process, laying the groundwork for future transactions. For lenders, it provides several key advantages:

- Establishing Borrower Credibility: A pre-approval demonstrates to both lenders and sellers that a borrower is financially capable of securing a mortgage.

- Streamlining Approval Process: By collecting essential financial information and documentation upfront, lenders can expedite the overall approval process.

- Identifying Financing Options: Pre-approval allows lenders to provide tailored loan options that fit the borrower’s financial profile.

It is essential for lenders to communicate effectively with borrowers regarding pre-approval requirements, ensuring all necessary documents are collected to facilitate a quick review.

The Application Stage Explained

The application stage is where the borrower submits a formal request for a mortgage. Lenders have a critical role at this stage, needing to evaluate the application thoroughly. Factors to focus on during this stage include:

- Understanding Borrower Needs: Engaging with borrowers to understand their goals (e.g., purchase or refinance) can help in recommending suitable products.

- Careful Document Verification: Lenders must scrutinize income documentation, credit histories, and employment verification to assess risk.

- Transparency in Requirements: Clearly communicating what is needed from borrowers can prevent delays or issues down the line.

Key Documentation Required

To process a mortgage application, several key documents are typically required. These include:

- Income Verification: Pay stubs, tax returns, and possibly W-2 forms.

- Credit Reports: To assess the borrower’s creditworthiness, lenders need to pull a credit report that includes the borrower’s credit score.

- Asset Documentation: Bank statements and proof of other assets help determine the borrower’s ability to make a down payment and cover closing costs.

Having a checklist of these documents can help streamline the application process and improve customer satisfaction.

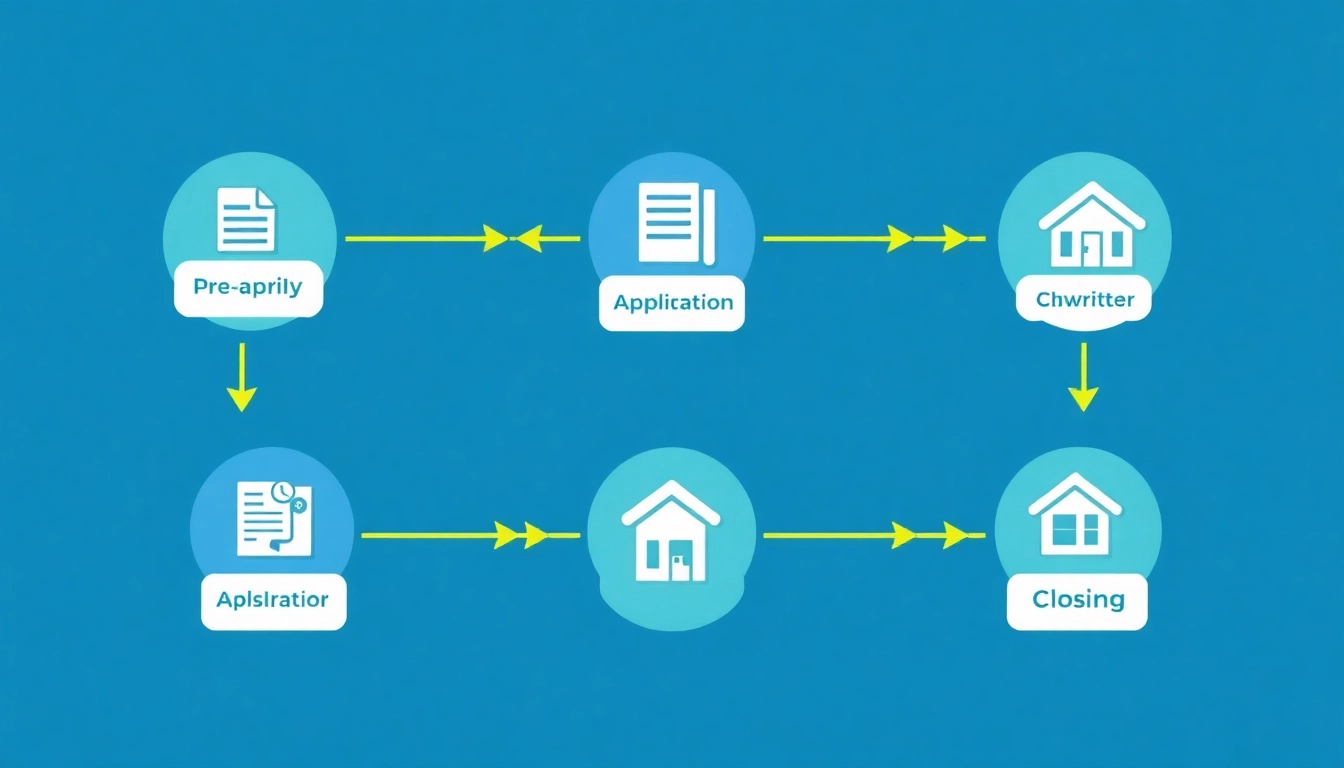

Steps in the Mortgage Process: From Pre-Approval to Closing

Preparing for the Loan Application

Before the loan application is submitted, lenders should prepare by:

- Gathering Comprehensive Information: Ensure that all data related to the borrower’s financial background is complete and organized.

- Educating Borrowers: Providing information about loan types, interest rates, and expected timelines can help set realistic expectations.

- Establishing a Communication Plan: Regular updates can keep borrowers engaged and reduce their anxiety throughout the process.

What Happens During Underwriting?

Underwriting is a critical step where lenders assess the borrower’s risk and determine whether to approve the loan. Key components of underwriting include:

- Risk Assessment: Underwriters evaluate different risk factors including creditworthiness, income stability, and the value of the property.

- Condition Review: Underwriters often place conditions on the approval, such as requiring additional documents or clarifications.

- Tie to Compliance: Ensuring the loan meets all regulatory and compliance standards is paramount.

Engaging experienced underwriters and providing them with accurate, complete information is vital for a smooth underwriting process.

Finalizing the Loan and Closing

The final step involves closing the mortgage, where all parties sign documents, and funds are transferred. Lenders must focus on:

- Preparing Closing Documents: This includes loan agreements, title documentation, and disclosures.

- Coordinating with Other Parties: Lenders must liaise with real estate agents, title companies, and the borrower to schedule the closing.

- Post-Closing Procedures: Ensuring that all paperwork is correctly filed and the loan is transferred to servicing.

Timely follow-up and clear communication during closing can significantly influence borrower satisfaction.

Common Challenges Lenders Face in the Mortgage Process

Addressing Appraisal Issues

Appraisal discrepancies can arise, impacting loan approval. Lenders should take steps such as:

- Utilizing Reputable Appraisers: Collaborating with experienced appraisers who understand the market can minimize issues.

- Emphasizing Transparency: Keeping communication open with borrowers about the appraisal process can help manage expectations.

Understanding Borrower Credit Score Impact

Credit scores are a crucial factor in mortgage lending. Lenders should:

- Educate Borrowers: Providing insights into how credit scores affect loan terms helps borrowers be more proactive.

- Implement Pre-Qualification Processes: This can allow borrowers with low credit to understand their options and prepare to improve their scores.

Navigating Complex Transactions

Complex transactions may involve unique circumstances such as self-employment or multi-party agreements. Lenders can address these challenges by:

- Engaging Specialists: Having experts who specialize in complex transaction types can provide valuable guidance.

- Fostering Cross-Department Collaboration: Ensuring that different departments within the lending organization work together improves workflow and reduces risks.

Best Practices for Streamlining the Mortgage Process

Creating a Smooth Communication Channel

Effective communication is critical throughout the mortgage process. Implementing platforms that enable real-time messaging can enhance engagement between lenders and borrowers.

Implementing Efficient Loan Processing Systems

Investing in technology that automates aspects of the loan process, including document collection and status updates, can improve efficiency significantly, reducing time to close.

Training Staff on Compliance Regulations

Providing regular training on regulations and compliance requirements helps minimize risks, ensuring all staff are up-to-date with practices that protect both lenders and borrowers.

Measuring Success: Key Performance Metrics for Lenders

Tracking Time to Close Metrics

Establishing KPIs around how long it takes to close loans can help lenders identify bottlenecks and improve process efficiency.

Understanding Customer Satisfaction Ratings

Soliciting feedback from borrowers regularly can help gauge satisfaction and identify areas for improvement. Metrics might include Net Promoter Scores (NPS) and post-transaction surveys.

Evaluating Conversion Rates at Each Stage

Analyzing conversion metrics at each stage of the mortgage process offers valuable insights into drop-off points and areas needing enhancement. Continuous improvement can lead to better borrower experiences and increased loan approval rates.